Maximizing Your Loaning Prospective: Tips for Making the Many of Funding Opportunities

The globe of lendings can be a complicated and sometimes discouraging one, with various opportunities presenting themselves in different forms. It all begins with a thoughtful assessment of one's financial standing and a proactive attitude in the direction of leveraging financing possibilities.

Analyzing Your Financial Scenario

Upon starting the trip to maximize financing opportunities, it is crucial to start by extensively examining your present financial situation. Understanding your financial standing is the cornerstone of making educated choices when it concerns borrowing cash. Beginning by examining your income, expenses, properties, and obligations. Calculate your debt-to-income proportion to see just how much of your earnings goes towards settling financial obligations. This ratio is an important statistics that loan providers consider when establishing your qualification for a car loan.

Investigating Lending Choices

To properly navigate the landscape of finance opportunities, complete research study into various finance options is vital for consumers looking for to make informed financial decisions. Carrying out comprehensive research includes checking out the conditions offered by different lenders, understanding the kinds of finances readily available, and contrasting rates of interest to identify the most beneficial alternatives. By delving into the specifics of each car loan product, debtors can get understandings right into payment terms, charges, and prospective charges, allowing them to choose a financing that straightens with their economic objectives.

Furthermore, consulting with monetary experts or finance officers can give customized advice based on specific circumstances. Inevitably, comprehensive study empowers debtors to make well-informed decisions when picking a lending that suits their demands and financial abilities.

Improving Your Credit Report

After thoroughly investigating loan choices to make educated economic decisions, customers can currently concentrate on enhancing their credit rating to enhance their total borrowing capacity. A greater credit report not only boosts the chance of lending authorization yet also enables borrowers to gain access to car loans with much better terms and lower passion prices. To boost your credit report, beginning by getting a duplicate of your credit rating report from major credit report bureaus such as Equifax, Experian, and TransUnion. Testimonial the record for any kind of mistakes or inconsistencies that might be negatively affecting your click this score, and quickly address them by getting in touch with the credit history bureaus to fix the errors.

Understanding Financing Terms

Understanding loan terms is crucial for customers to make educated financial decisions and effectively handle their loaning responsibilities. Some car loans may have prepayment fines, which debtors must consider if they plan to pay off the loan early. By extensively recognizing these terms before agreeing to a loan, consumers can make sound financial choices and avoid possible risks.

Creating a Settlement Strategy

Having a clear grasp of loan terms is basic for customers looking for to produce a well-structured repayment strategy that aligns with their economic objectives and decreases potential threats. As soon as the funding terms are understood, the following step is to create a payment method that matches the consumer's economic abilities. The initial consideration needs to be setting a practical timeline for repayment. This includes assessing earnings resources, budgeting for regular repayments, and accounting for any type of foreseeable modifications in economic situations. Furthermore, focusing on high-interest lendings or those with rigid settlement conditions can assist lower overall financial obligation worry with time.

If troubles occur in meeting settlement responsibilities, informing the lending institution early on can open up opportunities for renegotiation or restructuring of the lending terms. Inevitably, navigate here a well-thought-out repayment strategy is important for meeting funding obligations sensibly and preserving a healthy and balanced monetary account.

Verdict

Finally, optimizing loaning potential needs a comprehensive evaluation of financial condition, study on loan choices, enhancement of credit report, understanding of finance terms, and the production of a structured payment plan (Online payday loans). By complying with these actions, people can take advantage of funding possibilities and attain their financial goals efficiently

Jaleel White Then & Now!

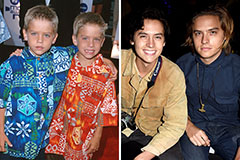

Jaleel White Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Tonya Harding Then & Now!

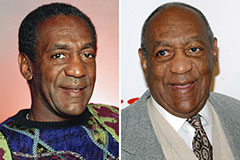

Tonya Harding Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!